Pakistan’s No.1 AI Tax Management and Filing System

Streamline your tax management and filing process with TaxDaar, the ultimate solution for tax consultants and taxpayers in Pakistan.

- Taxpayers

- Tax Consultants

Collect all necessary tax documents, including income statements, investment records, and receipts for deductions.

Create your TaxDaar account and securely log in to the platform.

Enter your personal and financial information into TaxDaar's user-friendly interface.

Utilize TaxDaar's tools to identify eligible deductions and credits, maximizing your tax savings.

Review your tax return for accuracy and completeness before securely filing it online through TaxDaar.

Receive real-time notifications on important tax deadlines, updates to tax laws, and the status of your tax return.

Add new clients to your TaxDaar account and securely onboard them into the system.

Upload and organize your clients' tax documents within TaxDaar's centralized platform for easy access.

Communicate and collaborate with your clients in real-time, sharing documents securely and providing timely assistance.

Utilize TaxDaar's tools to prepare and review tax returns for accuracy and completeness before filing.

Electronically file tax returns securely through TaxDaar, ensuring compliance with all regulations.

Stay updated with the latest tax laws, regulations, and industry insights provided by TaxDaar, enhancing your expertise and service offerings.

Discover the Benefits of Being an Active Tax Filer with TaxDaar. Filing your taxes promptly and accurately isn’t just a legal requirement – it’s a smart financial move. By becoming an active tax filer, you unlock access to valuable tax credits, deductions, and financial opportunities. At TaxDaar, we’re dedicated to helping you understand the importance of tax compliance and empowering you to manage your taxes effectively. Explore the advantages of being an active tax filer and maximize your savings today!

Tax Savings

Claim tax credits on investments & tax returns for taxes paid on utilities, cars, properties, etc.

Minimal Withholding Taxes

Avoid most of the withholding taxes by simply becoming an active filer.

Zero Penalties

Failure to file tax returns can lead to prosecution by FBR, Federal Board of Revenue. Avoid all such prosecutions and penalties by becoming an active tax filer.

Compliance Checked

Most of the formal agreements and transactions now require an active FBR tax filer status. Avoid any delays in the processes by becoming an active tax filer.

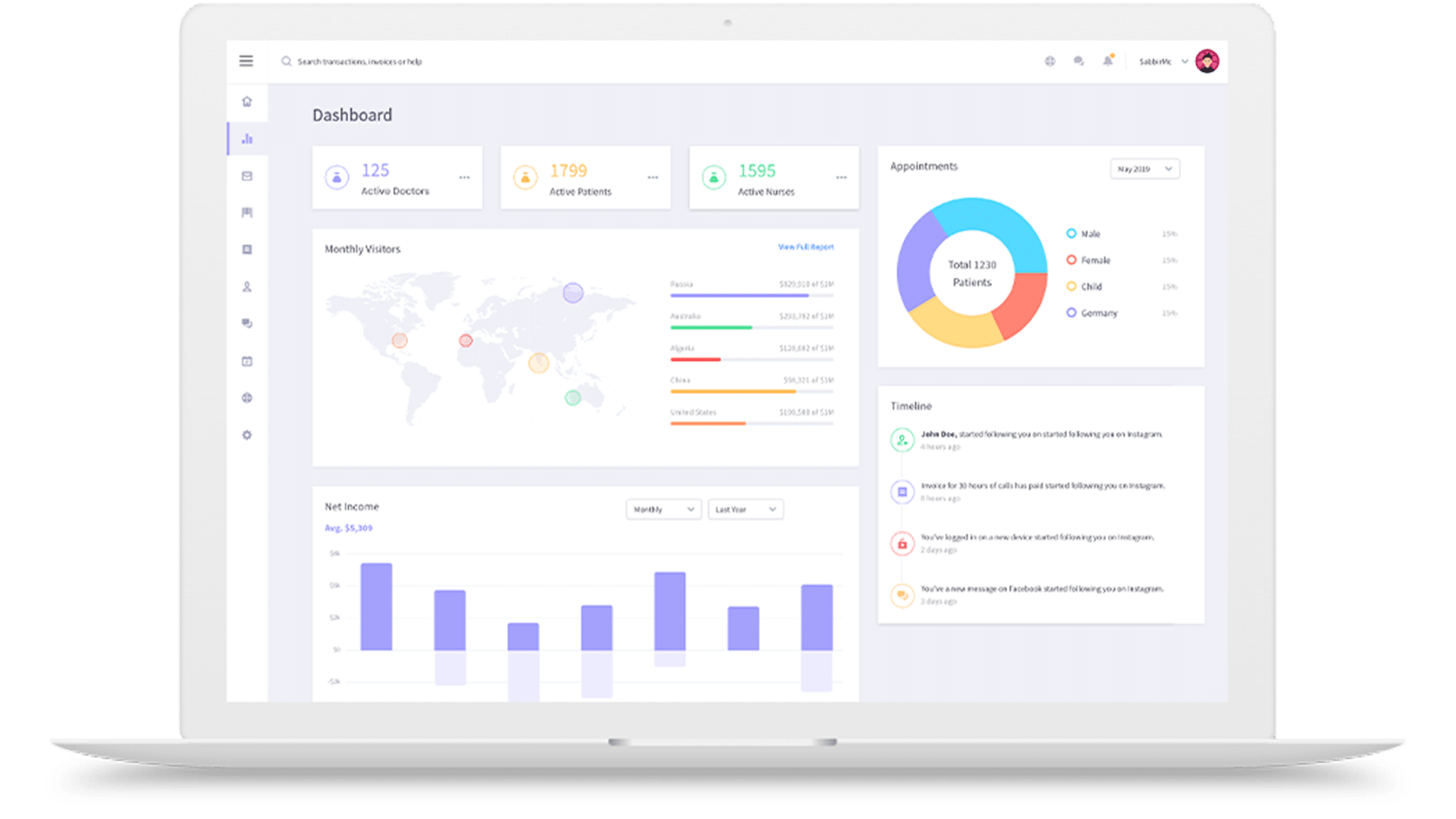

Simplify your tax filing process with our intuitive and user-friendly system.

Easy Filing

File your taxes easily and accurately with our guided process.

Automated Calculations

Let our system handle complex calculations, ensuring accuracy and saving you time.

Multi-User Access

Collaborate with your team and clients seamlessly with our multi-user access feature.

Real-time Tracking

Stay updated on the status of your tax returns with our real-time tracking feature.

Secure Storage

Rest assured that your sensitive data is stored securely and protected with our robust security measures. TaxDaar ensures complete privacy.

Compliance Alerts

Stay compliant with the latest tax laws and regulations with our timely alerts and notifications.

TaxDaar aims at simplifying the process of tax management for the common man. Become an active filer today and choose TaxDaar to manage your tax records effectively amongst other benefits.

Feel free to contact us for further queries @ [email protected]

TaxDaar is a tax management and filing system designed for tax consultants and taxpayers in Pakistan.

Yes, TaxDaar allows you to file your taxes online easily and accurately.

Yes, TaxDaar is designed to cater to the needs of businesses and individuals alike.

Yes, TaxDaar uses robust security measures to protect your sensitive data and ensure confidentiality.

Yes, our dedicated customer support team is available to assist you with any queries or issues.

Yes, TaxDaar is fully compliant with the latest Pakistani tax laws and regulations.

Join to get access to Pakistan’s best Tax Management System.